Competitive Advantage of Cooperatives and DAOs

My friend groups and blog feeds have been buzzing about worker cooperatives (coops) and decentralized autonomous organizations / corporations (DAOs). In this post I’ll explain both and explore when they might have an advantage over traditional forms of organization (e.g. traditional C-corporations).

I’m interested in both as social / digital technologies that could play a meaningful role in the economy. In general, alternate forms of organizations are exciting in their potential to positively transform labor and productivity. However, in order to be viable, new organizations must have some intrinsic competitive advantage over traditional corporations in at least some set of market scenarios.

Worker Cooperatives

Worker coops have been around since the industrial revolution. They are owned and managed by the workers themselves; there aren’t external investors / shareholders and leadership is beholden to the employees.

The Bay Area has a number of coops including Arizmendi Bakery and Rainbow Grocery. The largest and most successful coop is the Mondragon Corporation in Spain, which employs ~75,000 people across 257 companies and had 2013 revenue of over 12 Billion Euros. The BBC did a nice documentary on Mondragon back in 1980. They’re also featured in Shift Change, which I haven’t watched but is supposed to be good.

The touted benefits of a worker coop include:

- Better alignment between workers and managers - workers are electing the managers / leaders

- Improved job stability - coops don’t usually have layoffs and, with Mondragon, risk is diversified among various subsidiaries

- Better productivity because workers are more engaged / invested in the production process

All of these advantages can be found in traditional organizations though, diversification of risk through conglomerates like GE, better worker engagement through lean manufacturing techniques, etc.

Decentralized Autonomous Organizations

DAOs are a core of independent algorithms running the “firm’s” activities and interfacing with third parties (humans or computers) in an automated manner. Most talk around DAOs take place within the context of Bitcoin and other cryptocurrencies. The cryptocurrencies come in as a blockchain or distributed ledger might be a good substrate on which DAOs can run.

DAOs are meant to be perfectly transparent, impartial, trustworthy, and resilient. Because they are automated, they might avoid principle-agent issues emergent in traditional firms and might also maintain lower costs (no shareholders /employees to reward).

Because of some of the aforementioned characteristics, DAOs aren’t meant to be modified much once they’ve launched. This means they are poor candidates for rapidly shifting contexts or markets.

Competitive Advantages

I think the real competitive advantages of both coops and DAOs derive from the fact that they don’t need to optimize on shareholder returns. This allows them to under price competitors to gain market share and optimize on other factors (job stability / satisfaction for coops and cost / transparency for DAOs).

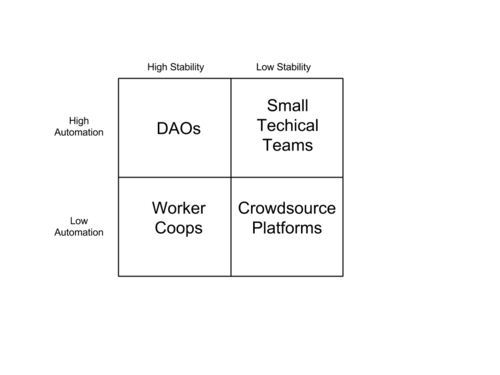

In figuring out when coops and DAOs might make sense, I think the two main factors are are automation and context stability. Automation is simple - how well the key activities of the firm can be performed via algorithm. Context stability is about how fast the business context is changing; low stability could be due to disruptive innovation, shifting regulation, etc.

Low Stability / High Risk

The right half of the 2x2 features low context stability - likely high uncertainty and risk. This is makes it a poor place for both coops and DAOs, but for different reasons. Coops are better off in high stability markets because they want to optimize on job stability for the workers. DAOs should avoid high uncertainty niches because it should be hard / slow to change their core algorithms, thus hindering their ability to adapt in a shifting market.

The low stability represents a high risk / high reward opportunity that may be attractive for entrepreneurs. If the solution can be automated, a highly technical team can keep working on algorithms / software until they find something that works. If automation is a poor fit, they might look to creating a crowdsource platform (e.g. AirBnB).

High Stability

As mentioned before, coops and DAOs may only be relevant in niches of high stability where the problems and solutions are well understood and innovation is low. This removes much of the product and execution risk and reduces the chance of the organization suffering from innovative disruption in the near term.

If the solution can involve a high degree of automation, DAOs might be a good candidate. They might be set up to reduce transaction costs in a simple online marketplace, auction site, or even stock / currency exchange.

If the solutions involve low automation, coops might be a good fit. The Bay Area coops I mentioned fit this example - bakeries and supermarkets. A currently high-risk markets stabilize, there might be room for coops to win market share. See below for some speculation about coops in the ridesharing space.

Other Caveats There are probably many other factors that make markets unattractive for DAOs and coops. Beyond high risk, these new forms probably do poorly entering markets with high barriers to entry. High capital requirements are not necessarily a barrier to coops and DAOs but until there are more successful examples these alternative organizations might struggle to raise enough funds.

Mondragon is a big exception to the last point. They have their own bank which can provide serious financing for new cooperative endeavors. The banks evaluation process is long, strict, and likely unfriendly to any group trying to act like silicon valley startups. Because Mondragon is so diverse, though, they can probably afford to take bigger risks with startup coops - workers from failed attempts can easily rejoin other coops.

Mondragon ventures also have the benefit of a built in audience - other Mondragon firms and employees. This can lower a lot of the initial risk. It reminds me of Y Combinator startups who gain all of their initial traction by selling to other companies in the YC network.

Coops vs Uber

I’m going to end this post with a hypothetical new worker’s coop - an Uber Competitor. Ridesharing might be a good place for a coop to emerge because the solution is fairly clear and standardized - Uber, Lyft, et al have similar apps and functionality. Further - incumbents are competing fiercely over drivers and offering large incentives for switching. Also, there seems to be low customer loyalty; riders seem to go to the company with the cheapest fares.

Lyft and Uber take 20-25% of the fare. A rideshare coop could split that between the drivers and passengers, thus becoming a more attractive platform for both parties.

I see the biggest risks to this approach as:

1) The market still isn’t stable and a coops wouldn’t be able to keep up with innovation 2) Uber and Lyft use their massive funding to subsidies their rides, operate at a loss, and make competition hard for the coops.

I’m not sure how realisitic either of those risks are but I think the soon the time will be right for a rideshare coop experiment.

Final Thoughts

I hope this post helps you think about when coops and DACs might work and when they’re likely to fail. If you disagree with what I’ve said or have interesting examples of either - please bring them up in the comments!